Influencer who bought Trump a Rolex as a gift admits he has lost at least $10,000,000 since the president enforced tariffs

Influencer Adin Ross reveals 'terrible' impact of Trump's tariffs on his wealth. On April 2, Donald Trump labeled it 'Liberation Day' for America, announcing additional tariffs worldwide aiming to see 'American industry reborn'. Trump's tariff strategy? One social media user suggested the 47th US President made a risky 'chess move' by 'intentionally crashing the market'. Financial experts have cautioned that these new foreign goods taxes could severely impact Americans' savings. One person feeling the effects - quite severely - is internet personality and streamer Adin Ross.

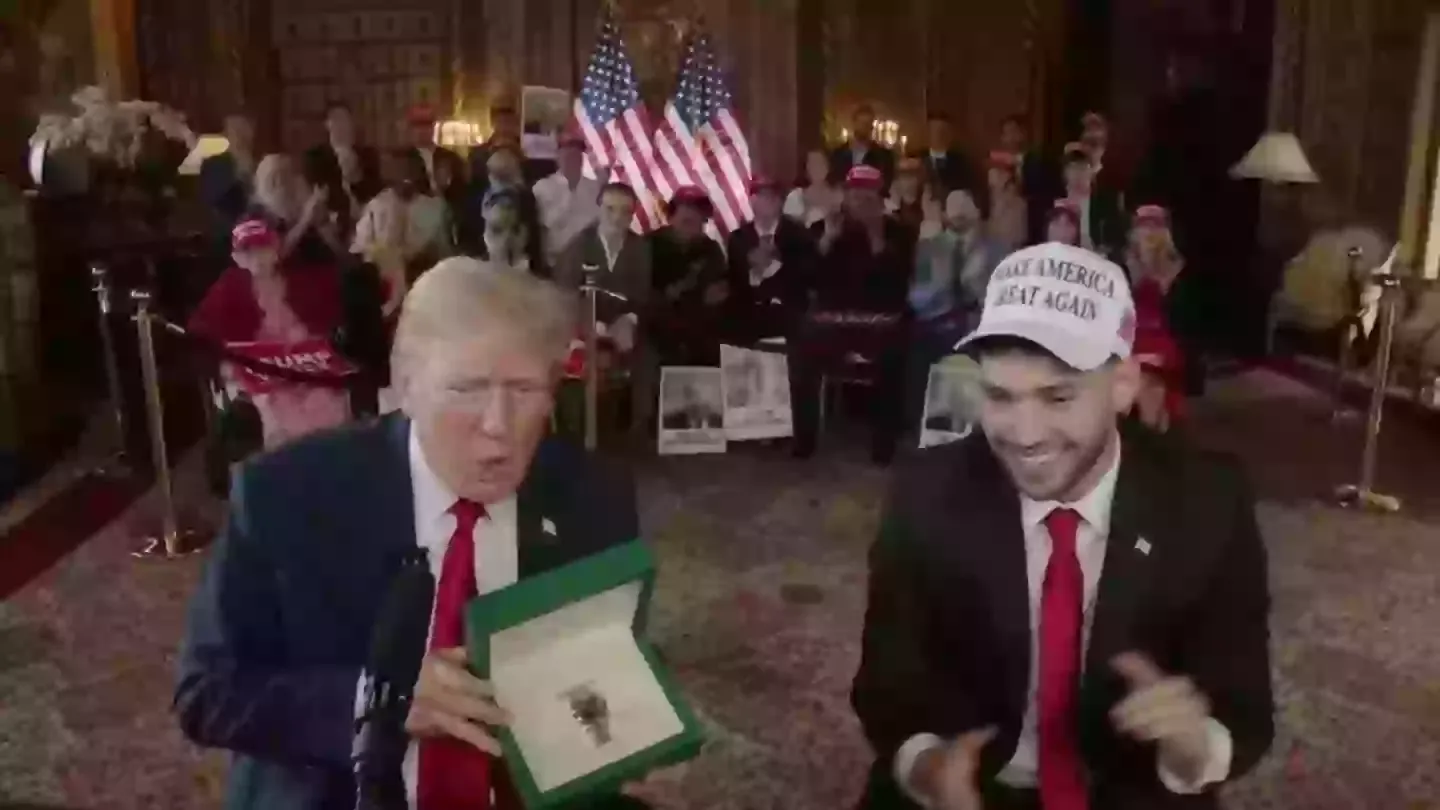

Ross previously hosted Trump on streaming platform Kick.com's 'Just Chatting' section last year, presenting him with various gifts including a gold Rolex. He might have saved that money, as Trump's tariffs have now damaged his finances significantly.

In a video called "DJ Akademiks Comes on Adin Ross' Stream!", the influencer discussed the 'stock market issues,' noting how 'very bad' the situation is and asking if America faces a possible 'recession'. DJ Akademiks responded that Trump is playing 'a game of dangerous chicken' and hopes Trump will 'stop' the tariffs soon to negotiate, but acknowledged people are currently suffering - including Adin.

Despite giving Trump a Rolex, Adin hasn't escaped the tariff consequences, stating: "We all are. Bro. Holy f*** it's so bad." He then revealed losing 'eight figures' - at least $10,000,000 - since the tariffs began. He admitted: "It's bad I'm not gonna lie to you bro. It will get better though."

Public reactions came quickly. One Reddit user commented: "'Influencer' who 'bought Trump' a 'Rolex'.....is probably the shortest and most clear sentence possible to express the f***ing sad foolish stupidity of the timeline we're in." Another simply stated: "I love karma like this, who doesn't?" Remember, the brain's frontal lobe typically completes development by age 25.