New footage shows Trump explaining how his billionaire friends seemingly made billions from his tariff war

President Trump praises wealthy associates for making money from trade war shortly after encouraging Americans to invest in the stock market. Video has emerged showing the 78-year-old GOP candidate bragging that two of his already wealthy friends had gained over $3 billion collectively as stocks temporarily recovered. Early yesterday (April 9), the President posted on Truth Social: "THIS IS A GREAT TIME TO BUY!!! DJT."

Someone apparently took his advice - not the investment company but the actual person named Charles Schwab, as Trump pointed out. Speaking from the Oval Office, he quipped: "This is Charles Schwab...it's not just a company, it's actually an individual!" He then described how Schwab earned $2.5 billion in the stock market, while another friend made $900 million. This stands in stark contrast to the financial situation of typical Americans, many of whom are preparing for a possible economic downturn.

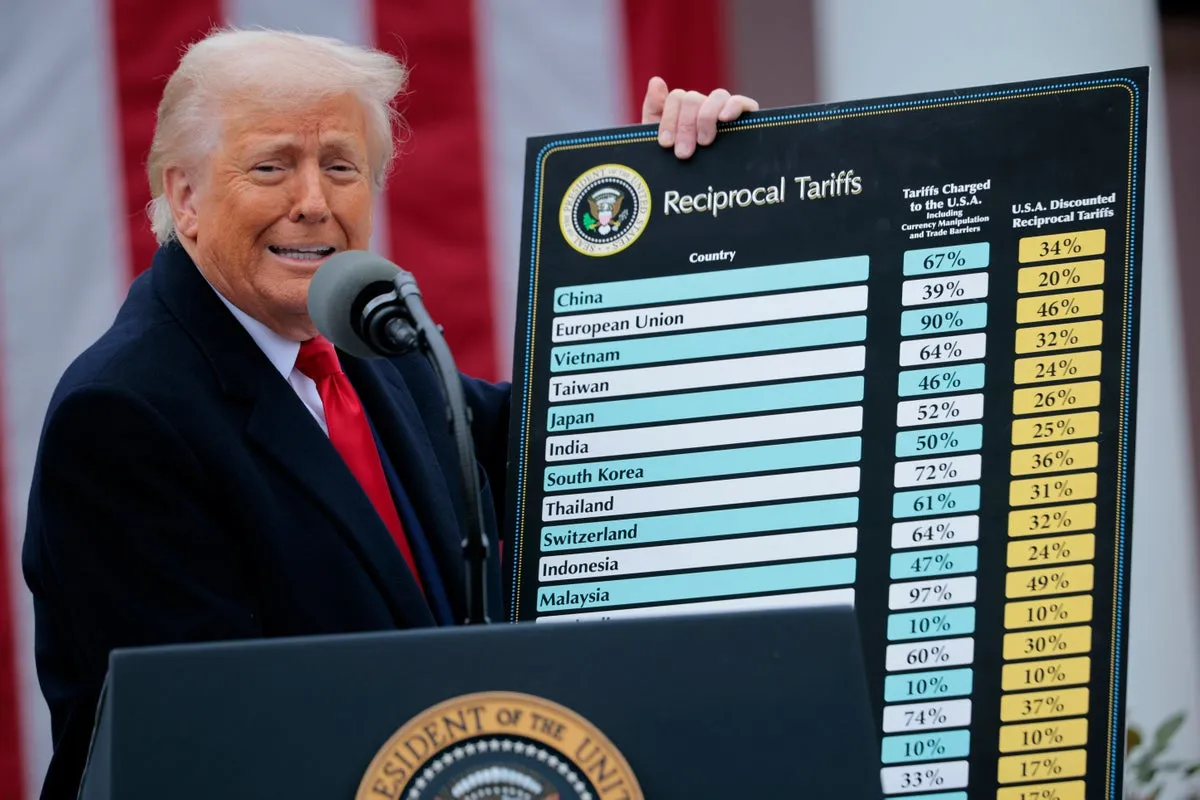

The President's investment tip came less than four hours before he announced a 90-day suspension of tariffs previously imposed on numerous nations. "Based on the lack of respect that China has shown to the World's Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately," he stated on his social media account. "At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.

"Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed."

President Donald Trump holds up a chart while speaking during a 'Make America Wealthy Again' trade announcement event on April 2 (Chip Somodevilla/Getty Images)

The president continued: "Relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States.

"I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately. Thank you for your attention to this matter!"

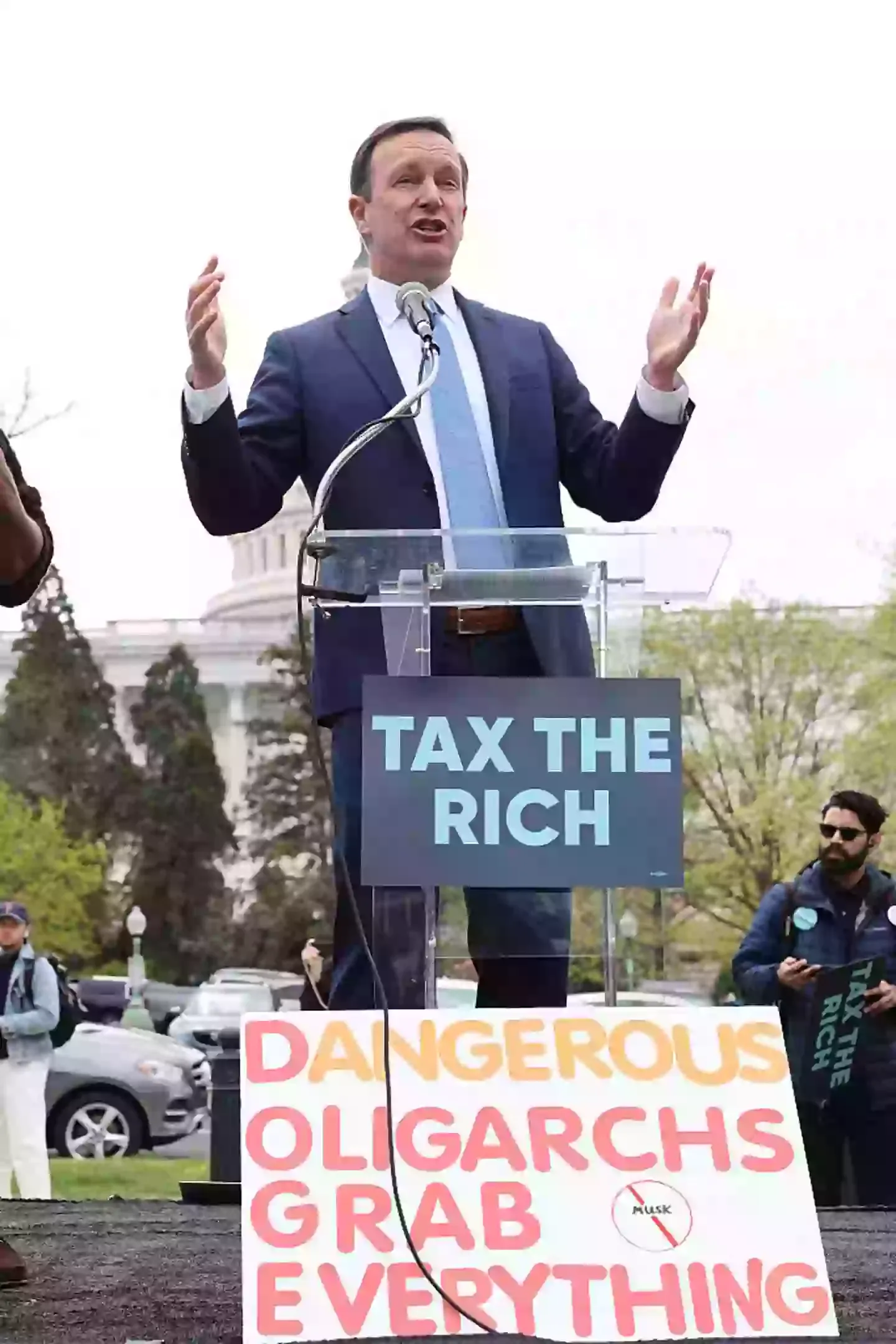

Senator Chris Murphy has suggested Trump's advice could infringe on insider trading standards (Jemal Countess/Getty Images for Fair Share America)

Critics have attacked Trump for telling followers to purchase stocks before suspending the tariffs, with some suggesting this might constitute insider trading. US Senator for Connecticut, Chris Murphy, stated: "An insider trading scandal is brewing.

"Trump's 9:30am tweet makes it clear he was eager for his people to make money off the private info only he knew.

Others have expressed concerns about the timing and ethics of Trump's statements. Financial analysts question whether the President's public investment recommendation followed by policy changes that affected markets creates an unfair advantage for those with close connections to him.

The stock market did indeed show significant movement following the tariff suspension announcement, with major indexes climbing as investors responded positively to the temporary trade war pause. This rapid market response further fueled speculation about whether those with advance knowledge had positioned themselves to profit.

White House officials have defended the President's actions, arguing that his recommendation to buy stocks was simply based on his general optimism about the economy and not tied to specific policy announcements. They maintain that the tariff decisions were made through proper channels and followed appropriate protocols.

Critics remain skeptical, pointing out the unusual sequence of events. Some legal experts suggest regulatory agencies might need to examine whether securities laws were violated, particularly regarding selective disclosure of market-moving information.

The controversy adds to ongoing debates about potential conflicts of interest in the administration, with opponents arguing that the President's business background and wealthy associates create situations where personal financial interests might influence policy decisions.

Trump supporters counter that the President's business experience gives him unique insight into economic matters, and that his wealth means he isn't motivated by financial gain while in office. They view his stock market tip as simply sharing his economic confidence with the American public.

As markets continue to react to the tariff policy changes, the discussion about the propriety of the President's comments and their timing is likely to continue, with potential implications for regulatory oversight and public trust in financial markets.